Amazon Reviews

Konrad Bobilak has featured in:

#1 Best Selling Book On Amazon

In The Category of Real Estate Investments

Konrad Bobilak is helping thousands of everyday hard-working Australians to move closer to their goal of

True Financial Independence

Dear Fellow Property Investor,

If you’re someone who dreams about owning a large Residential Investment Property Portfolio, which will enable you to attain Financial Independence through property investing, then this may very well be the most important letter that you’ll ever read!

I know that you may be skeptical about this claim. If you’re anything like me, chances are, you’re the person who scratches their head in frustration and wonders how other people seem to make a fortune in the property market while you’re left out in no man’s land floundering.

And that is precisely why this very well might be the most important book that you will ever read.

By learning and implementing the proven step-by-step strategies outlined in this book, you will finally be empowered to fast track your investment property portfolio and start living the life you and your family truly deserve!

In fact, you’re about to discover a Proven Step-By-Step Buy and Hold Real-Estate Investing System …that is easy to follow and makes so much sense that I promise you that by the end of reading this book you’ll be wondering why nobody has told you about it before.

In fact, you’ll be mad at everyone around you who have been putting doubts into your mind about the possibility of you owning a substantial residential property portfolio, I know, like you, I have been there myself many, many times over the last twenty-five years!

If you’ve ever felt ‘overwhelmed‘ or ‘stressed out’ with the seemingly insurmountable task of living your life…just getting by day-to-day without any hope of stopping work before you’re completely stuffed and old…with no energy or money left over to enjoy a happy, stress-free, successful life; to travel to faraway places, to give to your favorite charity whenever you like or simply have the time and financial freedom to do whatever you darn well like… then this book was written just for you!

In fact, the contents and step-by-step secret recipe outlined in the book took me some 25 years to learn and implement and has taken me some three years just to write this book!

Not only that, by pleading and twisting some arms, I managed to convince my Accountant, Solicitor, Financial Planner, Property Manager and my Quantity Surveyor to contribute a chapter each to this book, and share their industry knowledge and secrets that literally took them a lifetime to acquire…and believe you me, these guys are literally the best in the industry!

“One thing that I must stress is that this is NOT a get-rich-quick scheme, and I guarantee that you will NOT become a millionaire overnight by following this system. I am not going to insult your intelligence or make unrealistic claims.”

So, if you want to Get-Rich-Quickly, you might as well stop reading right now and forget about buying this book immediately!

As this book is definitely not for you… you might want to try investing in IPO’s, Cryptocurrency, Selling vitamins on AMAZON, or Exercise Equipment on eBay, or whatever the latest flavour of the month thing is right now…

And good luck with these!

This book is based on teaching you how to build, Structure and automate, a multi-million dollar property portfolio in your spare time, that will eventually enable you to replace your job income and to follow your true purpose or destiny!

Not only that, you will learn how to, with laser-like precision, identify the very best long-term performing suburbs in Melbourne, and different types of specific properties within these suburbs that outperform the majority of the market, in terms of Capital Appreciation, medium to long term.

You will also learn how to do this in Australia’s major capital cities, and how to best Structure your investment property in the most tax-effective way, passively, whilst optimizing your loan structures in such a way that your home loan is paid off in record time!

If that sounds like something that you want to learn, then keep reading!

Did you know that historical evidence proves that Australia’s $6.9 trillion dollars residential property market has outperformed all other asset classes over the last 100 years, based on average annual compounded growth?

Yet despite the extraordinary performance of the Australian residential property market, very few Australians have managed to grow substantial property portfolios.

With most people struggling to find a balance between their hectic professional and family lives, it’s no wonder that only a small fraction of the Australian population ends up investing in residential property.

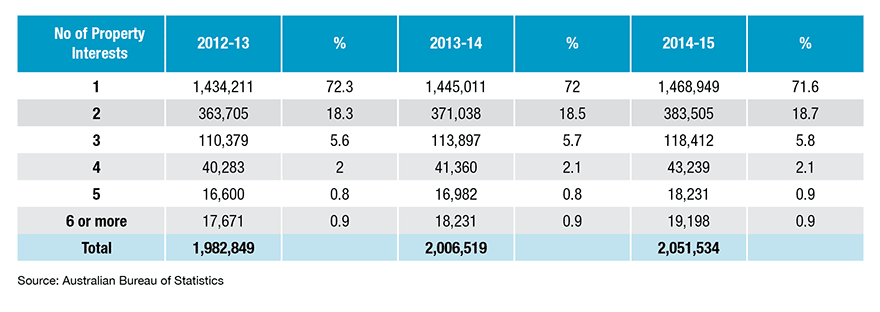

The latest figures from the Australian Taxation Office (ATO) show that 71.6 per cent of Australian property investors own just one investment property, 18.7% of Australian property investors own exactly two investment properties, and less than 1 per cent of property investors in Australia own six investment properties or more…

So only 1 per cent of the entire pool of property investors own more than six investment properties…

It seems crazy? Doesn’t it?

Many sophisticated investors and experts believe the missing ingredient that separates the 1 per cent from the rest is financial literacy and lack of specific knowledge.

And I agree entirely with them…

The problem is that no one is really teaching the topic of financial literacy specifically when it comes to residential property investing, and more specifically, no one is teaching the specific methods that are used by sophisticated property investors to build and structure their multi-million dollar property portfolios…

Until now that is…

So let me ask you something…

Would you like to learn what only the 1 per cent of property investors in Australia know and practice…

Buy your Hard Copy or Digital PDF version now Including FREE delivery anywhere in Australia

So What’s In The Book,

Well Here Are The Actual Chapters…

But before we go any further, I know what some of you might be thinking by now?

So Why Should You Listen To Me?

My name is Konrad Bobilak, I live in Melbourne, and apart from being a successful property investor, I am the author of the bestselling book in Australia’ Australian Property Finance Made Simple’, 1st edition published in 2015!

- Bachelor Of Business Management, Monash University, B.Bus (Mgt),

- Certificate IV in Property Services (Real Estate) CPP40307,

- Certificate IV in Financial Services (Mortgage Broking) FNS40804.

- Diploma of Financial Services (Financial Planning) FNS50804, RG 146

I became passionate (on the obsessive side) in real estate investing some 25 years ago, at the age of 18, and ever since I caught the property investing bug, I have strategically worked in a variety of industries that allowed me to gain a real insider’s perspective on how successful property investors in Australia really made money from investing in property.

Along the way I completed a Bachelor of Business Management (B.Bus.Mgt), at Monash University, specializing in Organizational Change, later undertaking further studies in Financial Planning, Mortgage Brokering eventually focused on my ultimate passion, Real Estate.

In addition, I have had extensive experience in Managed Funds, Risk Insurance, Real Estate Sales, Commercial Lending, Residential Lending, and Asset Finance, as well as being a Financier for one of the four major banks.

In my varied roles, working predominantly with high net worth individuals, I have literally had a wealth of exposure to the unique mindset and financial structures of truly successful people and investors.

The objective of all my roles in the various industries that I worked in for the past 25 years or so was twofold.

- To get to understand why certain people succeed in real estate investing and why others fail, and,

- To get to work personally with people who are successful property investors, and here I am talking about the 1 per cent of the very best in the country.

And guess what…!

And a cool thing happened along the way…

My unique insights into ‘Wealth Psychology’ combined with highly specialized knowledge of the Finance and the Real Estate Industry in Australia, made me a sought-after Real Estate and Finance’ Key Note’ speaker and successful real estate investor.

Over the last 12 years, I have had the privilege of having taught tens of thousands of people in Australia, New Zealand and Fiji, as well having the unique opportunity of sharing the stage with the likes of Sir Richard Branson, Tim Ferris, and Randi Zuckerberg in audiences of up to five thousand people.

But here is the real kicker…

The number 1 reason why you should listen to me, is that beyond all my credentials and practical hands-on-industry experience… I have achieved significant results as a property investor myself, having successfully built a Multi-Million Dollar Property Portfolio in Australia that has enabled my wife and my 9-year-old daughter an extraordinary lifestyle!

The kind of lifestyle that I want for you and your family to achieve!

Hence, this book has been written by a real property investor, for Australian property investors who are looking to build substantial wealth right now, in 2020.

So I am NOT an Academic with no results, just letters after their name, or some academic so-called-expert Professor or Economist who is broke with no assets behind them, pretending to know what is really happening in the market.

There are thousands of these so-called-expert Professors or Economists in Australia, and I can tell you that most will end up dead-broke at 65 on a government pension, alone, with no assets behind them. (Gee, I’ sound so harsh!)

Or worst yet, some know-it-all so-called-self-proclaimed Fly-In-American property expert, who is kind enough to fly to Australia, and purely out of the kindness of their hearts, to teach us how to make money in very own cities and market!

Or worse even still, the know-it-all so-called-self-proclaimed Fly-In-American property expert who flies over to warn us how our overpriced real estate market will inevitably CRASH in 2020! Just like it was supposed to crash back in 2019, and in 2018, and in 2015, and in 2011, and definitely during the Global Financial Crisis in 2008, or back in the Stock Market Crash of 1997, or just like it was supposed to Crash the other 25 times it was supposed to crash, but it didn’t, over the last 60 years! In order to save us from ourselves! Thank You! God bless Americans!

No, I am NOT any of these… I am a real Melbourne-based real estate agent, who grew up in the suburb of Elwood, (we rented a two-bedroom flat, so no, I wasn’t born with a silver spoon in my mouth living in Elwood…I could feel you judging me) with a current real estate office in St. Kilda, who walks the talk, and I am in the market every day talking to property developers, property valuers, mortgage brokers and financers and MOST IMPORTANTLY very successful property investors, in the trenches, many of whom are making an absolute killing in the market, irrespective which part of the property cycle we are in!

And I can honestly tell you that there is absolutely NO SUBSTITUTE for this kind of in-the-market-street-level research!

PLUS…I also back up all my conclusions and recommendations about the market with Fundamental Research with Actual Technical Research by tapping into data from RP Data Core Logic, REIV, HTW and APM just to name a few!

And this is exactly the type of real information that I have included throughout the many chapters of this book.

But enough about me, let us get back to you…

Whilst a small percentage of the Australian population has managed to increase their wealth through property investing, very few are actually maximizing their returns, and fewer still have worked out how to optimize their financial structures best.

Whether or not you are aware of this, this is costing you money, and more importantly the opportunity cost of time, and missing out on the potential of paying off your (non-tax deductible ‘bad debt’) home loan sooner, as well as missing out on accumulating more investment properties (tax-deductible ‘good debt’) in your property portfolio.

Buy your Hard Copy or Digital PDF version now Including FREE delivery anywhere in Australia

And Here Is The Harsh Reality…

From my personal experience and observations working in the Mortgage Broking and banking industries, most property investors settle for under-performing property portfolios as well as unsuitable loan structures that are robbing them of thousands of dollars per year…

The Good News Is That You Don’t Have To Be One Of Those People

And that’s the reason why I wrote this book… this was my number one objective!

You see, whilst there is a plethora of information out there on how to find the best performing suburbs and properties, and about market timing, etc., very few books and/or individuals are teaching the fundamentals behind how to best Structure a large property portfolio, from purely a finance perspective.

That’s where the ‘Australian Real Estate Investing Made Simple’ comes in…

This book reveals the ‘secret recipe’ on how to correctly structure your finances with the objective of maximizing leverage & tax efficiency, whilst focusing on buying more investment properties and simultaneously paying off your home loan in record time.

So, let me ask you something…

“Would you like to ” know what this ‘secret recipe’ is that I am referring to here?

If your answer is an resounding ‘Yes’, then keep on reading…

I call it the ‘Property Investing Wealth Formula’…

But here it the thing…

Perhaps the most important aspect of your investing journey is ‘to start’ investing; too often first-time investors become overwhelmed and overloaded with due-diligence, differing opinions, and many suffer paralysis from analysis and end up delaying the investment process indefinitely.

Building and structuring a multi-million-dollar property portfolio that will eventually free you from work is based on a specific process, much like a recipe for baking a cake.

When you want to bake a cake, you locate that special recipe you want to prepare. Then it’s a simple matter of sourcing the right quality ingredients, adding them in the correct sequence, and following the rest of the directions until you arrive at the finished product.

The key is, to make sure that you get quality ingredients, in the correct order, or your cake will not be a success.

Building wealth through property is basically the same.

The key is to conduct research, find out how other successful property investors have built and structured their property portfolios, who and what they have sourced, how they have made their money work for them, and for you to do the same.

Once you have found the winning recipe or plan that has worked for other successful investors, then it becomes a simple matter of repeating the process until you have built and structured your investment property portfolio correctly.

And although this process sounds simple, as you will find out by reading this book, it’s actually not easy to do, as there are very few successful property investors in Australia who have managed to build large property portfolios, and very few professionals who can help you get there.

So, the million-dollar question is …what’s the recipe?

Well, that’s exactly what this entire book is about, and, from a high-level perspective, here is the recipe, broken down into four essential elements or ingredients.

There are four critical components or ingredients if you like that make up the winning recipe for successfully building a large multi-million-dollar property portfolio that will enable you to achieve financial independence;

- Cultivating the right investor PSYCHOLOGY,

- Developing the right PLAN and SYSTEM,

- Developing a team of EXPERTS around you, and

- Understanding PROPERTY SELECTION METHODOLOGY!

When all four components of this winning recipe are added together in the right sequence, using quality ingredients, and at the right time…magic happens!

But just like baking a cake, it’s very easy to get the quality of the ingredients wrong, or to mix them in the wrong order or to simply leave the cake in the oven too long and burn it!

Then, of course, there is the actual recipe itself, which outlines the exact method and order that the ingredients are mixed with each other. Following a recipe or a proven formula is the essential part of maximizing your chance of succeeding as a successful property investor.

Let’s examine the first component of the formula, Investor Psychology, which is perhaps the most important component of the Property Investing Wealth Formula.

Ingredient #1

Cultivating the right Investor Psychology

The term Investor Psychology will mean different things to different people, especially when it comes to the world of property investing, given that there are so many approaches and strategies that exist in this realm of investing.

For example, there are buy and hold investors buying growth properties, investors interested in cash flow positive properties, investors who renovate properties and manufacture capital growth, investors who secure properties via option contracts and on-sell them, and investors who buy property for the purpose of re-development, subdivisions, re-zoning…the list is endless.

Ultimately, there are some commonalities linking all these investors, and their approach to property investing, and it has more to do with what belief systems they adhere to and how they operate.

As Wallace D Wattles put it in his famous book ‘The Science of Getting Rich’, the rich get rich by;

“Doing things in a certain way” not by doing “certain things”.

Wallace D Wattles

In other words, it’s not what you do, it’s the way that you do it, and that’s what gets results.

That is, these individuals understand a few fundamental principles about successful investing. Primarily, they know that in order to become wealthy, they must be comfortable with acquiring debt. Specifically, they focus all their efforts on accumulating growth assets, using good debts, or tax-deductible debts, while avoiding taking on bad debts or consumer credit, which has no tax advantages to secure assets that devalue over time.

Furthermore, investors with the right Investor Psychology tend to use other people’s money or OPM.

For example, they use the maximum Loan to Value Ratio, say 95% and are comfortable paying Lenders Mortgage Insurance (LMI) as they know that the most crucial aspect of investing is in assessing the Return on Equity (ROE) not Return on Asset (ROA).

They also do not own any assets in their own name; that is, they use Trusts and Corporate Trustees to Control Assets rather than to Own Assets.

This is a huge distinction that is incongruent with what the average Australian is conditioned to believe about property acquisition.

You see Rich people simply Control Assets; they don’t necessarily Own them!

It’s the Poor and Middle Class in Australia that has been conditioned to believe that they need to on everything in their own names and pay all their assets off!

This makes them literally a Walking target when it comes to litigation!

Always remember, ‘Whatever get grouped together, dies together!’…

Finally, investors with the right Investor Psychology invest in their own personal development and network with like-minded individuals, who support their investing endeavors.

They understand that the only risk in investing in them, not the market and that the market, whether it is the property market or stock market, is simply a vehicle that transfers wealth from the uneducated to the educated.

Which is exactly what is happening right now in the Australian property market in 2020!

You see the most successful property investors in Australia understand that time is the most precious commodity, and they know that investing in property is simply buying time in a market that has a proven history of growth with certain properties.

Remember that ‘You can always get more money…but you cannot get more time!’

Furthermore, you must understand that 80% of the determining factor that guides your ultimate success in this game is the ability to cultivate a winning investor’s psychology.

You would have noticed that I have written the word ‘cultivate‘, which by definition means to acquire or develop a quality or skill. Simply put, most successful people are not born with winning psychology; rather, they spent years working on and acquiring the right success psychology, which sets them apart from other non-successful people.

Successful property investors study other successful property investors, leverage networks of experts and specialists in their field, and most importantly believe that they are in complete control of their destination and life in general.

Successful property investors tend to take full responsibility of every facet of their lives and hold the belief that their circumstances don’t determine their level of success, instead their actions do.

That is, they tend to rise above their circumstances and achieve success despite their financial, academic, or cultural background and often achieve success despite the odds.

Don’t let your circumstances, friends, family, and society in general default you into a life of mediocracy!

Successful property investors take complete responsibly for where they are in life, this is especially true for where they are financially, and hold the ultimate belief that they can change and improve virtually every aspect of their life, as long as they make the decision to do so!

As Henry Ford best put it;

“If you think you can do a thing or think you can’t do a thing, you’re right.”

~ Henry Ford

On the flip side of the coin, and therefore by definition; unsuccessful property investors, or to a larger extent, unsuccessful people, generally speaking, hold the life governing belief that they have no control over anything in their life, especially their finances, and often they become life’s professional victims of circumstances. They continuously blame their circumstances and others for where they are in life and refuse to take any responsibility for their results.

Unsuccessful people tend to be negative, often complain about their circumstances, but do nothing to change them, surround themselves with other negative likeminded individuals, and often seek out evidence in the media or literature that creates the justification for their reality of sub-living a life of quiet desperation!

So, let me ask you a rhetorical question…which team will you be playing for?

Team Life-Victim or Team Success?

Now, I said it was a rhetorical question, as the very fact that you are reading this book already tells me that you have a very high probability of ending up successful in property investing as numerous studies have shown over the years that unsuccessful people never ready any self-development or investment books in their entire life!

So as long as you source the best quality ingredients, follow the proven recipe outlined in this book, and follow a life-long commitment to the process of self-development, you will succeed!

As Abraham Lincoln best put it;

“The best way to predict your future is to create it.”

~ Abraham Lincoln

Ingredient #2

Developing The Right PLAN And SYSTEM

This is perhaps the most crucial ingredient in the recipe of successfully building a multi-million-dollar property portfolio and one that this often overlooked or entirely neglected by novice property investors. Your ability to develop an all-encompassing, tailored-made investment plan could quite literally mean the difference between succeeding and failing in the property game.

The process of correctly identifying and locking in your starting point, and then your ultimate investment objective or outcome destination ensures that you will stay on course is a key process that is extensively covered in the book. It’s is extremely important that you develop an ability to clearly articulate and write down your property investing goals and be as specific as possible.

The more details you include in your plan and the more clarity you have about who and how to implement your plan, the more likely are to succeed. Generally speaking, there are the main ways to generate a passive income from your property portfolio.

- You can live off a line of credit (LOC).

- You use your line of credit (LOC) for share trading.

- You can sell a portion of your property portfolio and pay off all your debt and live off the rental return of your unencumbered investment properties.

The type of investment strategy will largely be determined by your level of risk profile, and time horizon for investment. Your Risk profile will be largely determined by your age, or close you are to 65 years of age, your level of financial literacy, your level of equity that you have available to invest into your property portfolio, and how much actual time you have available per week to invest in property. This book explores these points in more detail and enables you to create an individual, all-encompassing investment plan, based on property acquisition, that is right for your specific set of circumstances.

Remember that if you aim at nothing, you will hit it with great accuracy every single time!

Ingredient #3

Mastermind Team Of Industry Experts

Other specialists are needed to bring the Investor’s plan to fruition.

That is, one needs a solicitor to settle the property, a real estate agent to sell the property, a mortgage broker to submit the loan to the bank…and so on.

These specialists form the individual’s Mastermind Team of Industry Experts.

Most successful property investors are themselves not experts in every single field of property investing. Rather, they become generalists, relying on their Mastermind Team of Experts, and they leverage from their expertise and knowledge. Such a team may include, but is not limited to the following individuals:

- A Mortgage Broker or Banker,

- A Property Sourcing Specialist,

- A Property Accountant,

- A Property Solicitor,

- A Financial Planner,

- A Property Manager,

- A Quantity Surveyor,

The key to your success, which is the basis of this book, is to develop your level of Specialized Knowledge to such an extent, that you can:

- Prequalify and shortlist your key Mastermind Team of industry experts.

- Coordinate them in a manner that will enable them to implement the necessary steps and actions that will eventually lead to your desired outcome.

The difficulty with accurately identifying and prequalifying the relevant experts which will ultimately form part of your Mastermind Team lies with the Investor’s level of Specialized Knowledge in that particular field, and their ability to ask the right questions in order to prequalify and shortlist them.

This is why I have had chapters in this book contributed by my personal mastermind team of industry experts and specialist to this book, not only to explain exactly what they all do, and where they fit into the large picture but more importantly to elevate your level of awareness and teach you how you can start prequalifying your very own mastermind team of industry experts and specialist.

Remember that your success, as a property investor, to a large extent, will be ONLY as good as your team!

Or put it another way, your cake will taste as good as the ‘quality’ of the ingredients that you source.

Ingredient #4

Understanding Property Selection Methodology

You probably may have heard an old saying; Land Appreciates and Buildings Depreciate, hence the money is always in land. Which brings me to one of the most important Key Drivers of Capital Growth to appreciate, (and there are quite several them!), that is, that Not all Land is Created Equal.

That is, 100 square meters of Land in Richmond will always outperform 1,000 square meters of land in Melton. Always remember that 80 per cent of the growth is based on the location, and only 20 per cent of growth is based on the type of dwelling.

That is, in most cases, the location of the block of land, rather than size will determine the level of capital growth, as long as there are two factors simultaneously present.

- There is the scarcity of land, and the most important one…

- There is strong demand by people who have high disposable incomes, or the right demographics.

This combination of ‘scarcity of land’ in desirable, highly sought-after suburbs, combined with ‘high demand form people with high disposable incomes’, are the Key growth factors behind capital growth of different suburbs in Melbourne.

This book explores in detail Australia’s top 20 highest capital growth suburbs over the past 10 years, as well as Australia’s top 20 lowest capital growth suburbs, and the Key determining factors responsible for these outcomes.

This section of the book is a complete eye-opener for most property investors, as it enables you with laser like precision to hone in on specific high capital growth suburbs and then specific type of properties within these suburb that have the highest probability of outperforming the general market medium to long term, constituting an essential part of any serious property investors knowledge base!

By reading this book not only will you learn the ‘secret sauce recipe’ or a proven formula is the essential part of maximizing your chance of succeeding as a successful property investor. Thus elevating you into he top 1% of property investors in Australia, you will also gain an insight into the type of Specialized Knowledge that you must acquire if you objective is to build and structure a Multi-million dollar property portfolio in the most efficient way possible!

The Specialized Knowledge that I am referring to here refers to the actual strategies which will allow you build a multi-million dollar property that will have the potential to fast -track you to financial independence and leave a true-legacy for your future generations!

More specifically, the Specialized Knowledge parts of the book refer to the Investor’s financial literacy and depth of knowledge of their chosen area of property investing.

You see whether it’s property options, property development, subdivisions, buy and hold, flipping or renovations, the ultimate success will lie in the Investor’s grasp of the technical aspects of their strategy, together with their due-diligence or feasibility studies leading up to the deal.

By reading this book, you will gain a rare insight into the Specialized knowledge base of sophisticated property investors, and learn how to conduct property due-diligence and cash-flow analysis, what kind of loan to choose for you first and subsequent property, interest only, Principal and Interest, fixed or variable, (full doc or low doc), which lenders to approach, who the purchasing entity of the asset is to be, what kind of trust to use (discretionary, fixed unit, hybrid), how to read depreciation schedules, calculate negative/positive gearing just to name a few. It is of great importance that the Investor becomes aware with the language and function of all the aspects of their investment strategy if they are planning to win the property game!

A further example of using Specialized Knowledge explored in this book is based on the notion that most informed investors tend to use an Optimized Loan Structure, which is one that allows the property investor to have maximum flexibility and control over every single property that they control or own, either via direct ownership or via a trust/company structure.

So, each property is set up as a Stand Alone facility, that is, only one loan is taken against one property, and hence none of the properties are cross collateralized, all consisting of a variable true Line of Credit, with no mandatory repayments, and a self-capitalizing component built in with the loan, preferably with separate lenders.

To add to this Structure, the Line of Credit facility (LOC) will have an offset facility attached to it, allowing the Investor, and their partner to directly credit their salaries and rental incomes into their LOC, which in turn offsets the amount of interest that they pay on their Primary Place of Residence (PPR) if they have one. Their Specialized Knowledge is key to their ability to choose the most advantageous banking product, thus propelling their success forward.

However, beyond having an intimate knowledge of all aspects of their chosen investment strategy and its components, the individual is unable to implement his or her design without assistance from other specialists; this is undertaken by The Mastermind Team.

This book provides the reader with a real ‘insider’s guide’ into the lending world, outlining the key players in the mortgage and banking industry, and a detailed breakdown of the main lending products available on the market today.

This book highlights in detail, the main loan structuring techniques currently used by the savviest and most successful homeowners and property investors in Australia today, many of whom have paid off their homes completely in less than 10 years, whilst concurrently having built and structured multi-million dollar property portfolios.

All anecdotal scenarios and recommendations that are made throughout this book are drawn from years of real experience working at a very high level in the banking and mortgage broking industries, as well as having personally applied the very same loan structures myself.

By reading the ‘Australian Real Estate Investing Made ‘Simple’ book, you will gain an insight into the industry’s best practices that have been applied by other successful property investors who have built and structured multi-million dollar property portfolios, many of whom have achieved a significant level of wealth and financial independence that most people can only dream of.

Buy your Hard Copy or Digital PDF version now Including FREE delivery anywhere in Australia

But before we go any further, I must stress the fact that this is not a book that is written in a very vague way where the onus is on you to figure out what strategies to implement and it just gives you a motivational boost!

Far from it!

This book is written as a step-by-step color-by numbers manual of exactly what financial structures you must set up, and what specific types of investment properties you must buy, and what consultants to engage in order to become financially wealthy and independent though real estate investing.

Guys, I am not a motivational trainer or speaker!

I am someone who has walked the talk and achieved in building a large multi-million-dollar property portfolio from scratch, right here in Melbourne.

So here is just a small snapshot of some of the key distinctions that you will learn by reading this book;

You will discover the ‘secret ‘recipe’ on how to correctly structure your finances to maximize leverage & tax efficiency while focusing on buying more investment properties and simultaneously paying off your home loan in record time.

You will learn the three distinctive stages while you are building your property portfolio;

- The Acquisition and building stage;

- The Consolidation and refining stage,

- And the Harvesting stage

And how these stages will vary from Investor to Investor, and will differ depending on each Investor’s personal Risk Profile, and time horizon for investing, as well as the amount of time, money or equity available.

In this part of the book, you will gain a clear understanding of the importance of developing a personalized investment plan, based on your unique set of circumstances, and available resources.

This section of the book is literally priceless!

Not only do I share the exact method of finding and aligning yourself with these property experts and specialist, but I am going to give you a personal introduction to my very own team of companies that my clients and I have been using for two decades to achieve some incredible real estate investing results!

And here is the best part…you can start contacting these companies as soon as you finish reading this book and start building your very own property empire that will eventually have the potential to create financial independence in your life!

So what are you waiting for?

Start reading now!

Buy your Hard Copy or Digital PDF version now Including FREE delivery anywhere in Australia